Table of contents

Taxation of profit made on the sale of a property in the Netherlands

This article will be of use if:

- you live in the Netherlands, and

- you're going to sell a property located in a Dutch city (Amsterdam, The Hague, Rotterdam, Utrecht, Eindhoven, etc.), and

- you could use some information on the tax issues when you are selling property in the Netherlands

This post consists of the following topics:

- No capital gain tax in the Netherlands

- No tax on profit when selling property in the Netherlands

- Transfer tax paid by the buyer

- Exceptions to the rule

For your information: I am a 27-year-old Dutch guy myself with a lot of expat friends.

You might come across some medium-structured sentences. Let's say, my knowledge on the Dutch real estate market is far better than my English (feel free to send an email to info@mijnverkoopmakelaar.nl if the error is too large to ignore).

I share articles related to the Dutch real estate market, because I hate that expats are being exploited by my fellow countrymen, especially in the housing market.

Further down this page, you will find some information on what it is we do (Mijn Verkoopmakelaar) and how that could be of use during this selling process.

Let's get started.

1. No capital gain tax in the Netherlands

Let's start with a general view on taxation in the Netherlands. Here, the tax system is different from most other countries

Most jurisdictions tax the capital gains of their citizens. This is different in the Netherlands. Instead, your ownership is taxed, not the returns you make from them.

The Dutch tax system works with 3 different 'Boxes' (baskets). For this topic, only two boxes are relevant: Box 1 and Box 3.

Box 1 property as a residence

This is how your property is taxed when you live there yourself

Box 3 property as an investment

The tax authorities will use an assumed, fictional return on investment, and that they tax their citizens accordingly. I won't dig too deep into this, but it works like this:

- The first 50,650 euros in property value is tax-free

- 50,650 - 101,300 euros, tax rate: 0.56%

- 101,300 - 1,013,000 euros: 1.35%

- > 1,013,000 euros: 1.71%

2. No tax on profit when selling property in the Netherlands

When you sell a property in the Netherlands with a profit, this profit will not be taxed.

An example: You have bought a property in Amsterdam 4 years ago for €300,000. You sell this house now for €380,000. This results in an €80,000 profit. All of this money is yours to keep.

Tax treaties could prevent other countries (your home country) from taxing the profit you have made on your sale of a property located in the Netherlands. Whether your country exempts or deducts Dutch taxes paid, depends on your specific country and situation. Seek professional advice if you want to know what would be wise in your situation.

3. Transfer tax paid by the buyer

The acquisition of a property is not totally tax-free. The buyer needs to pay a transfer tax. The transfer tax rate on dwellings is 2%. The transfer rate on other real estate is 6%.

If you buy a property as an investment (Box 3), the transfer tax is 8%.

4. Exceptions to the rule

When you are not operating as an individual, but through a company or other entity, different rules apply. In this case, it is strongly advised to get professional support on this subject.

More on selling property in the Netherlands, here:

Selecting a local Real estate agent

Hopefully, this was of any help.

If you are planning to sell your property located in the Netherlands, we can advise you on what Real estate agents won't charge you those exploitative expat-fees, but local tariffs.

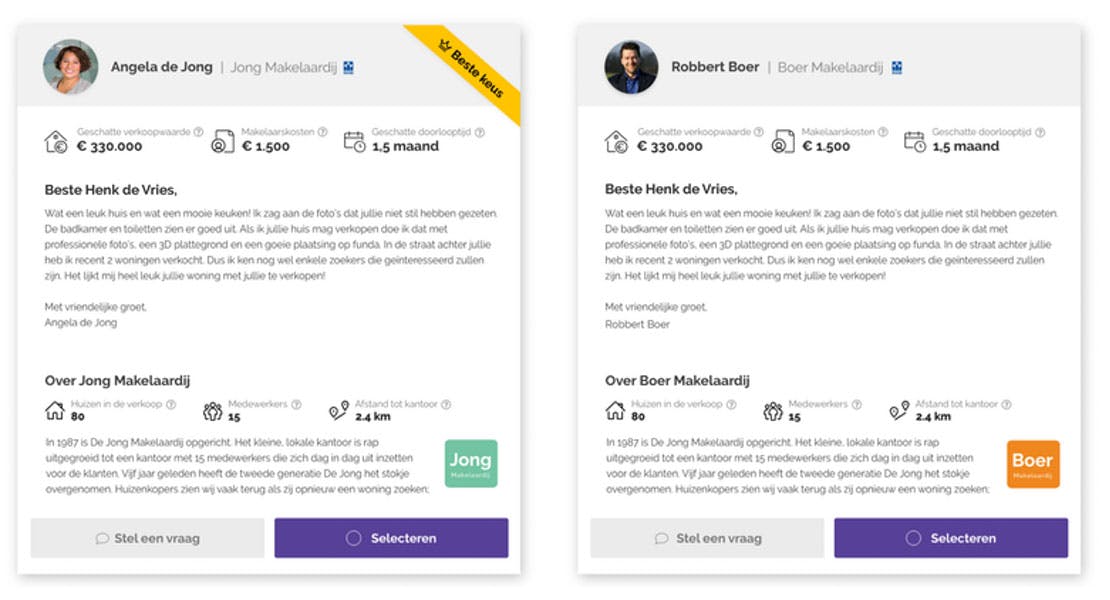

Follow the steps in our tool and find a Real estate agent in your area:

Hoe het werkt:

De makelaars in de omgeving zullen uw eigendom bestuderen en u een voorstel doen. Ze weten dat ze concurreren met andere makelaars, dus ze zorgen ervoor dat hun tarief concurrerend is.

Wij houden hun prestaties bij, zodat u verzekerd bent van een goed resultaat. En we houden contact met u.

Lange verhaal kort:

- Je krijgt meerdere aanbiedingen van makelaars in jouw omgeving

- We hebben de makelaars geselecteerd op basis van hun eerdere resultaten

- Het gebruik van de service is gratis voor jou (makelaars delen een klein deel van hun vergoeding)

- We houden je contactgegevens afgeschermd, dus je krijgt geen vervelende telefoontjes

- Vul je postcode hieronder in

Als je problemen ondervindt (taal bijvoorbeeld) bij het gebruik van het platform, aarzel dan niet om contact met ons op te nemen! We zijn hier om je te helpen in het Engels met een Nederlands accent ;).

- Verified

- Local

- Best results

Find and compare the best Real estate agents

FAQ on tax when selling property in the Netherlands

Do you have to pay capital gains tax on the sale of property in the Netherlands?

No. You don't have to pay capital gains tax on the sale of your property.

Do you have to pay extra tax on the profit you make on the sale of your property in the Netherlands?

No. You do not have to pay tax on the profit you make on the sale of your property in the Netherlands.

Which taxes need to be paid on the sale of property in the Netherlands?

The acquisition of a property is not entirely tax-free. In the Netherlands, the buyer is required to pay transfer tax. The transfer tax rate on dwellings is 2%. The transfer rate on other real estate is 6%.