Table of contents

Are you a first-time buyer and can't you find a suitable house on your own? Or is it difficult to get a (good) mortgage? Unfortunately, this is the reality for many first-time buyers. Have your parents indicated that they would like to help you buy a house? How nice, that could make a difference! In this article you will read about the 5 ways you can buy a house together with (or with help from) your parents.

Option 1: You receive a tax-free gift from your parents

The first way your parents can help you buy a house is by making a tax-free gift. In 2024, your parents can give you a maximum of € 31,813 tax-free. If you receive this amount, you as the recipient do not have to pay tax on it.

The condition is that you are between 18 and 40 years old and that you have not previously used a one-time increased exemption. Are you 40 years or older, but do you have a partner who does fall within the age category? Then you can still receive the gift tax-free. Does someone else want to make a gift to you for buying a house? For example, a step-parent or a good friend? The same rules apply to them. They can also donate tax-free up to a maximum of € 31,813.

In addition to financing a purchase property, you can also use the money for:

- The renovation or maintenance of your own house

- Paying off a mortgage or a residual debt of your own house

- The redemption of a leasehold, building right or encumbrance of your own house

The abolition of 'the jubelton'

The 'jubelton' was introduced in 2016. This was a tax-free gift of € 106,671 that parents could give to their children for the purchase of a house. It was used frequently, but there were also disadvantages to the jubelton. For example, it led to more inequality and higher bids on the housing market. That is why the government has decided to abolish the jubelton. In 2023 the gift amount was already reduced, from 2024 the jubelton is completely abolished.

Benefits of tax-free gift

Receiving a gift to buy a house has several advantages, including:

- You need less mortgage, so you have to pay less repayment to the mortgage provider every month. This means that your monthly charges are lower.

- You have more to spend and can therefore buy a more expensive house / make a better bid. This gives you more chance of finding a (dream) house.

- You have (possibly) the immediate opportunity to renovate your new house, tackle overdue maintenance and pay off a leasehold. Without the gift, you would have had to save for this and the costs could have been higher.

Tip: there are often costs associated with paying off large mortgage amounts. When you receive a gift in parts, you can pay the extra repayment in installments. This way you do not have to pay a fee to the mortgage provider.

Disadvantages tax-free gift

It would be wise to weigh up the possibility of a tax-free gift against alternatives, such as a family bank. A disadvantage of a gift can be that it is financially less attractive than other options. With a family bank, for example, you are entitled to mortgage interest relief. In addition, your parents also have more financial advantage. Have a conversation with a financial advisor to go through all the options. This way you know for sure that you choose the option that is best for all parties.

Read more about buying a house:

Option 2: You receive a loan from your parents (family bank)

A second way in which your parents can assist you in purchasing a nice house or apartment is by lending you money. This can be done through the family bank construction. Below you will read what this option entails, what the tax rules are (in 2023) and everything about the pros and cons.

What is a family bank mortgage?

As the name might suggest, a family bank is a mortgage that you take out from your parents. In other words: a loan that you take out from your family. For example, from your (grand)parents, an uncle or aunt, or a brother or sister. That's why the family bank is also sometimes called a 'family mortgage' or a 'family loan'. Or a 'parent-child mortgage' if you're borrowing from your parents. Just like with a regular mortgage, the house is the collateral of the loan.

Together with your family member, you determine the conditions of the family bank, which you record in an agreement. This includes conditions regarding the amount of the loan, the interest rate, the term of the loan, and the method of repayment. It is wise to record these conditions with a notary, but this is not necessary.

How does a family bank mortgage work?

A family loan works in the same way as a loan from a bank. Every month, you transfer a repayment amount and an interest amount to your family member. The difference with a regular mortgage is that with a family bank you can influence the conditions that apply together with your family member. This way, you can make the mortgage amount as high as you wish. This allows you to borrow more than 100% of the appraised value (this is not possible with a regular mortgage). You can use this extra money to renovate the house, buy off a ground lease, or finance the costs of buying a house.

In addition to the family mortgage, you can also apply for a regular mortgage. Keep in mind that the mortgage provider takes the family bank into account when determining the maximum mortgage. This probably results in a lower mortgage amount.

Take into account the following things when drafting the conditions:

- The interest rate you agree on must be market compliant. If this is not the case, the tax authorities may see part of the interest amount as a gift.

- If you want to make use of the mortgage interest deduction, the loan must be repaid linearly or annuitarily within a maximum of 30 years.

- In connection with the mortgage interest deduction, it might be wise to agree on a high interest amount. This is more advantageous for tax purposes. If your parents (or the other family member) wish, they can gift you back the excess interest paid (tax-free). Do you want to make use of this? Make sure you are well informed about the exact rules or make an appointment with a financial adviser or ask your Real estate agent for advice.

- Record all conditions in a loan agreement. Report the loan to the tax authorities and state that the family bank is being used for the purchase of a house.

The adjusted tax rules for the family bank construction in 2023

All wealth that does not fall under the category 'savings' is now seen by the tax authorities as an investment. In 2023, a (fictitious) return of 6.17% is calculated on investments. This is significantly higher than the returns calculated in previous years. From 2023, you also pay more tax on borrowed money than in previous years. You now pay 32% tax. In 2022 and 2021 this was still 31%.

Advantages of a family loan

The family mortgage has a number of advantages, such as:

- The mortgage interest is tax-deductible, provided you comply with the conditions.

- The mortgage interest that your parents receive is often higher than the interest they receive on a savings account.

- If you apply for a regular mortgage at the bank, you may receive a lower interest rate (because you pose a smaller risk).

Disadvantages of a family loan

The family mortgage also has a number of potential disadvantages, such as:

- Trouble can arise over the family mortgage if matters are not properly recorded, or if family members do not stick to the agreements. Therefore, it is a good idea to record all conditions neatly with the notary.

- A lot needs to be researched and arranged to make the family bank possible. Are you unsure about the right conditions or construction? Then consider having a conversation with a financial adviser or ask your real estate agent for advice.

The following is not a disadvantage, but it is good to know: it is not possible to get a higher mortgage from the bank if you have taken out a family loan. The bank takes the family loan into account when determining your maximum mortgage amount.

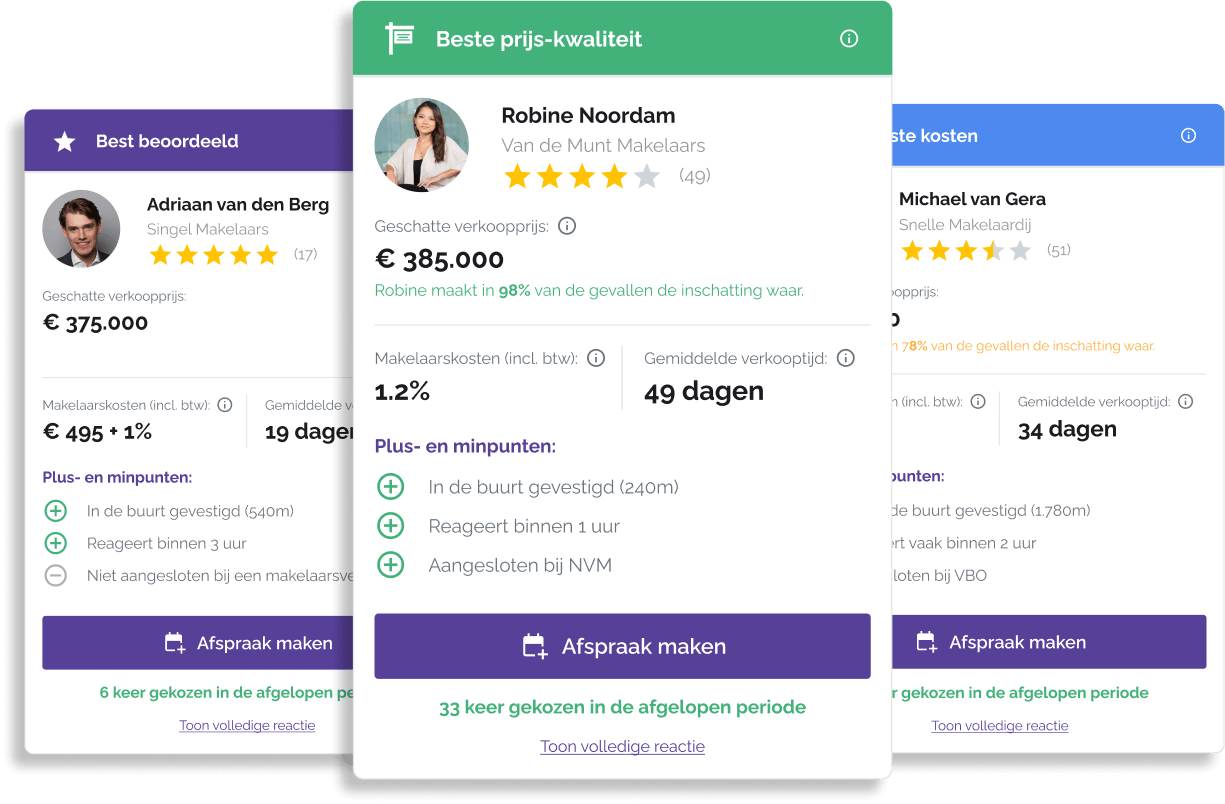

- Receive proposals from multiple real estate agents

- Get clarity about the costs beforehand

- Choose based on performance and results

- Over 10,000 people have preceded you

- Free & non-binding

- Independent

- Non-binding

- Free

- Fast

Option 3: You buy a property with a generation mortgage

A third way your (grand)parents can help you buy a property is with the generation mortgage. With the generation mortgage, you apply for a regular mortgage at the bank. For the portion of the mortgage that you cannot carry yourself, your parents sign. They guarantee that amount and are liable for this part. Therefore, not only your income, but also that of your parents, is tested by the bank.

Initially, you are responsible for meeting the monthly mortgage payments. If you are unable to meet the monthly payments (in full), your parents come into the picture. At that point, the bank expects them to step in to meet the mortgage. Has your income increased and stabilised? And can you fully carry the monthly costs yourself? Then the mortgage can be adjusted, so that it is entirely in your name.

Good to know: whether the mortgage can be entirely in your name will be assessed at that time based on the rules and criteria applicable at the time. Therefore, it is not possible to predict how long your parents will remain linked to the mortgage.

Option 4: Your parents buy a second home; you rent it from them

Is it not yet the right time for you to buy a house yourself, with the help of your parents? There is another way your parents can help you get a home, if they are financially capable. They could buy a second home to rent it to you. You pay them rent every month, just like in a 'normal' rental property.

You make arrangements with your parents about renting the property. One of these agreements could be that after a certain period you can buy the property, so you become a homeowner yourself. It is advisable to have all agreements regarding the property recorded with the notary.

Are your parents considering buying a house for you with their own money? You can read more about this topic in our article about buying a house without a mortgage.

Benefits of this option

A few benefits of renting a property from your parents:

- If your income is not higher than the standards of the Tax and Customs Administration, you as a tenant receive housing allowance

- You do not have to apply for a mortgage yourself (based on your income)

- Your parents have the opportunity to build up assets with a second home (especially in times of market growth and low interest, this is very advantageous)

Note: If your parents want to sell the property in the future, they must adhere to the rules of tenant protection. You can read everything about it in our article about selling a rented property.

Disadvantages of this option

A disadvantage for your parents is that they have to pay wealth tax on the house in box 3. This is the highest tax rate.

Option 5: Buy a house together with your parents

It is also possible to buy a house together with your parents. You then split the mortgage into two parts (50/50). You become 50% owner, and they become 50% owner. To arrange this, your parents need a large pot of savings or a good overvalue on their home. In this last case, they can use the overvalue to increase their own mortgage. With that increased mortgage, they can then finance part of your home.

Benefits of buying a house together with parents

The great advantage of such a construction is that your monthly costs are lower. You have more money left for paying the rest of the costs when buying a house. In addition, you have more money left for the rest of your fixed costs and doing fun things. For the part that you are the owner of the property, you get mortgage interest deduction.

Disadvantages of buying a house together with parents

The disadvantage is that you are not (immediately) the sole owner of the property. But hey, you have found a lovely house! Another disadvantage is that it is a second home for your parents. This means that they have to pay wealth tax in box 3. That is the highest tax rate.

Read more about purchasing a property:

Frequently asked questions:

Can you buy a house with help from your parents?

Yes, there are 5 ways you can buy a house with the help of your parents:

- Option 1: You receive a tax-free gift from your parents

- Option 2: You receive a loan from your parents (family bank)

- Option 3: You buy a house with a generation mortgage

- Option 4: Your parents buy a second house; you rent it from them

- Option 5: Buy a house together with your parents

Can you borrow money from your parents to buy a house?

Yes, it is possible to borrow money from your parents to buy a house through a family bank construction. This family bank mortgage is a loan you take out from your parents or other family members, with the house as collateral. Together with your family member, you determine the conditions, such as the borrowed amount, interest rate, term, and repayment method. It is wise to record the conditions with a notary, but this is not mandatory.

How does a family bank construction work?

A family bank functions in a similar way to a loan from a traditional bank. You pay a portion of the borrowed amount as well as interest to your family member every month. The distinction with a regular mortgage is that you can adjust the terms with your family member as desired. This allows you to increase the mortgage amount according to your own needs, even above 100% of the appraisal value, which is not possible with 'normal' mortgages.

How much can you give as a tax-free gift?

In the year 2023, your parents can give you a tax-free amount of up to € 31,813, provided you meet the conditions. As a recipient, you therefore do not have to pay tax on this donated amount.