Table of contents

Mortgage interest, it might not be the most exciting topic to read up on. Yet it is important! After all, you will deal with it for years when you buy a house. In this article, we explain as simply as possible what mortgage interest is and which factors influence its rate. Finally, we answer some frequently asked questions about mortgage interest.

Go directly to:

- What is mortgage interest?

- How high is the mortgage interest?

- How does mortgage interest develop?

- Frequently asked questions about mortgage interest

What is mortgage interest?

When you take out a mortgage with a bank or other lender, you pay a monthly amount to this party. This amount consists of repayment plus interest. The mortgage interest is therefore the interest rate you must pay the bank on the mortgage loan.*

*A mortgage loan is a loan for which a security interest (the mortgage) is established on real estate (buildings, houses). This security interest gives the bank the opportunity to sell your house if you can no longer pay the mortgage. This way, the bank still gets (part of) its money back.

On this page, we tell you everything about mortgage interest. But beware, you will face more costs when you take out a mortgage. You can read all about it on our page about mortgages.

Fixed and variable mortgage interest

As a buyer, you have the option for a fixed or variable mortgage interest when taking out a mortgage. Generally, a fixed mortgage interest is chosen more often, where the interest rate remains constant during a predetermined period, despite changes in market interest rates. This provides more stability. Fixed mortgage interests can be set for various periods, such as 5, 10, 20, or 30 years.

With a variable mortgage interest, the interest rate can fluctuate during the term of the loan. This interest depends on changes in market interest rates. Usually, the variable interest is based on a reference interest, such as the Euribor (Euro Interbank Offered Rate) or the lender's market interest. If the reference interest rises, your monthly mortgage payments will increase, and vice versa.

Variable interests are typically offered at lower rates than fixed interests but carry higher risk as they can fluctuate during the term of the loan. Fixed interests offer stability and more certainty about future payments. A mortgage advisor can further inform you about the differences, but ultimately you make the choice yourself.

How high is the mortgage interest?

How much interest you pay per month depends on various factors. Think of

- The moment you take out the loan

- The number of years you fix the interest

- The degree of financing

- National Mortgage Guarantee

- The mortgage lender you choose

For this article, we used the interest rates applicable in April 2024. For the most current interest rates, it is best to check websites that focus on this daily, such as actuelerentestanden.nl.

1. The moment you take out the loan

The moment you take out your mortgage loan is crucial for the height of the mortgage interest. The current mortgage interest is influenced by various time-dependent factors, such as:

- The general interest rates in the economy

- The central bank policy, such as raising or lowering official interest rates

- Economic conditions, such as economic growth, unemployment, and inflation

- International financial developments and events, such as geopolitical tensions or global economic trends

- Local market conditions, such as demand and supply of mortgage loans and competition among lenders

- Government policy regarding the housing market, such as the government plans for middle rent by Hugo de Jonge (2024)

These factors cause mortgage interest to vary daily. No matter how unfair it is, the moment you take out the loan has a significant impact on the interest rate.

There are many websites online that deal with estimating the developments in mortgage interest. You can consult these websites, but remember: these expectations offer no guarantees.

2. The number of years you fix the interest

When you take out a mortgage, you can decide for how many years you want to fix the interest. For example, for 1 year, 5 years, 10 years, 20 years, or 30 years (and everything in between). Each period has a different interest rate. In recent years, when interest rates were still low, it generally applied: the longer you fix the interest, the higher the interest. Now that mortgage interest rates have risen (as of writing: April 2024), this often still applies, but not always anymore.

Compare the percentages well with each other to determine which period you choose. Also, consider the expected interest rates in the future. When your period expires, you will pay the new interest rate at that time.

Example: At the time of writing, the lowest interest for 1 year is: 4.26%. With the same lender, the lowest interest for 30 years is: 4.26%. |

What is the most chosen length for fixing your mortgage?

The most chosen option is 20 years. Almost 60% of Dutch mortgages are taken out with a fixed interest for 20 years. At the time of writing, the lowest interest for 20 years is 3.78% and the highest option is 5.17%. A mortgage advisor can help you determine the fixed interest period, but ultimately you decide.

3. The degree of financing

For a bank, it is important to know whether they have to lend you the entire amount for the purchase of your house, or just a part. If you pay part of your property yourself, the bank incurs less risk and the lender charges a lower interest rate. We explain it to you below with an example.

Example: Suppose you buy a house for the fictitious amount of 100 euros. You put in 50 euros of savings yourself, and you borrow the remaining amount of 50 euros from the bank. After living in the house for a few years, you lose your job and can no longer pay the interest on the borrowed 50 euros. |

Many people take out a loan for a large portion of the purchase amount. This means they also pay more in mortgage interest. Below you can read the impact of the percentage of the purchase amount loaned on the interest.

Good to know: you can borrow up to 100% of the property value. If you want to make your property more sustainable, you can, under certain conditions, obtain a higher mortgage amount. In 2024, you can borrow up to 106% of the property's value.

Most commonly used percentages for mortgage lending: 60%, 80%, or 100% property value

The possibility of borrowing a certain percentage of a property's purchase value from the bank varies depending on several factors, including your financial situation, credit history, local regulations, and the lender's policy. On our page about mortgages you can read more about this.

Banks often work with different 'loan-to-value' (LTV) ratios. Here, the amount borrowed is expressed as a percentage of the property's value. The most common LTVs are 60%, 80%, and 100%. For percentages below 100%, you as a buyer must finance the remaining percentage yourself.

Example: The lower the 'loan-to-value', the lower the mortgage interest the bank charges. At the time of writing, the lowest interest rate for 20 years fixed at 60% is: 3.85%. With the same lender, the interest rate for 100% is: 4.60%. Quite a difference! |

Are you considering buying a house without a (full) mortgage? Read more on our page about buying a house without a mortgage.

4. National Mortgage Guarantee

A fourth factor influencing the height of your mortgage interest is whether you make use of the National Mortgage Guarantee. With an NHG, the interest you pay is (much) lower because the government guarantees certain situations.

If you sell your property at a loss, the remaining debt (the difference between what you receive for your house and what you must repay to the bank) is forgiven. The bank then receives the difference from the government. This is pleasant for the bank, as it incurs less risk this way.

Example: At the time of writing, the lowest interest rate for 20 years fixed with NHG is: 3.78%. |

The conditions for NHG

Not every mortgage qualifies for a National Mortgage Guarantee. In 2024, there is an NHG limit of €435,000. If the purchase price exceeds that amount, you cannot use the NHG unless the amount in the valuation report is within the limit.

If you want to invest in energy-saving measures when purchasing, you may finance up to 6% extra, depending on the property's energy label. This 6% can only be spent on these measures.

More conditions apply. You can read about them on the NHG website.

Good to know: you pay a one-time 0.6% fee to take out this NHG (2024). For the maximum amount of €435,000, this amounts to a one-time fee of €2,610.

Want to know more about the pros and cons of NHG? Then read more about the National Mortgage Guarantee.

5. The mortgage lender you choose

The last important factor is the specific mortgage provider. Assuming a 20-year fixed interest, NHG, the interest rates at the time of writing vary between 3.78% and 5.17%. This is a difference of 1.37%. It is certainly worth comparing the providers thoroughly.

Besides the interest rates, also consider the other costs when figuring out which mortgage is most advantageous. Think of closing costs and penalty interest that are charged. A mortgage advisor can help you with this during a mortgage conversation. It is good to know that costs for mortgage advice are also charged.

Additionally, include the mortgage form and other conditions (such as mandatory insurance) in your decision for a lender. For example, you can choose between a linear or an annuity mortgage. Both forms have different distributions in repayment and interest over the term. You can read more about this on our page about mortgages.

How does mortgage interest develop?

The big question everyone always has is: will interest rates rise or fall? We are not going to venture a prediction. There are plenty of websites that make predictions about the expected developments in mortgage interest rates.

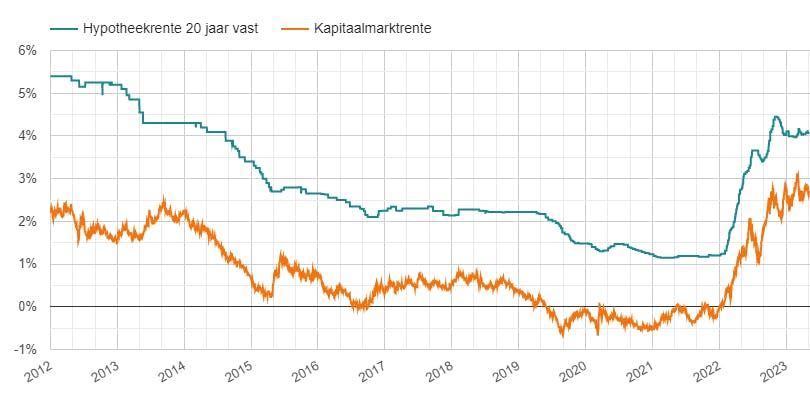

However, we found an interesting graph about the development of mortgage interest over the past years. As you can see, mortgage interest has increased significantly in the recent period (since 2022).

Source: HomeFinance

The orange line is the capital market interest. The capital market interest is the rate the Dutch state must pay when they take out a loan for 10 years. In 2012, at the beginning of the graph, the government had to pay 2%. In 2020, the interest was below zero. This means the government received interest on what they borrowed for 10 years.

The green line is the mortgage interest rate for 20 years fixed. What you see is that the lines follow the same development over time, with sometimes a small delay of the mortgage interest compared to the orange line.

You could therefore say that mortgage interest follows when the capital market interest rises or falls.

Read more:

Real estate agents make you a proposal

You will receive a response from the connected real estate agents in the area in which they introduce themselves, tell you what they think of your property. They make an estimate of what it's worth, how quickly it can be sold, and tell you what their working method is.

So you don't waste precious hours comparing and contacting real estate agents, and you can focus on your new home!

How it works

- Take a few photos of your property

- Sign up for free at Mijn Verkoopmakelaar

- Wait a week until all responses are in

- Choose one or more real estate agents you want to contact

Enter your postal code & house number:

- Multiple proposals

- Real estate agents from the neighborhood

- Quick & easy

Frequently asked questions about mortgage interest

What determines the amount of mortgage interest?

How much mortgage interest you pay per month depends on various factors. Consider:

- The moment you take out the loan

- The number of years you fix the interest rate

- The degree of financing

- National Mortgage Guarantee

- The mortgage lender you choose

Will the mortgage interest rate go down or up?

That is difficult to predict. However, it seems that mortgage interest rates with a little delay follow the decrease or increase of the capital market interest rate. This is the rate the Dutch government pays for a 10-year loan.

Can you deduct mortgage interest from taxes?

Yes, you can deduct the mortgage interest on the own home debt from your income in box 1. This is the box concerning income from work and home. Read more about this on the website of the Tax Authority.

Can you take the mortgage interest with you when you move?

If you move within the Netherlands and buy a new own home, you can usually take the mortgage interest with you to the new home. This is known as the "transition scheme for existing own home debts." You must meet certain conditions, such as selling your old home and taking out a new mortgage for your new home.

Always seek advice from a mortgage advisor or tax advisor, as specific circumstances can affect the possibilities and consequences of taking mortgage interest with you when moving.

Can you take the mortgage interest with you after a divorce?

In the event of a divorce or termination of a fiscal partner relationship, the mortgage interest can sometimes also be included. This can be the case, for example, if one of the partners takes over the house and continues the mortgage. The separating partners mutually determine whether this is possible.

Various legal and fiscal aspects are important here as well, such as the division of joint properties and the financing of the new mortgage. Therefore, always seek advice from a mortgage advisor or tax advisor.

Read more about divorce and owning a house.

Can you change the fixed interest rate period of your mortgage?

Yes, it is possible to change the fixed interest rate period of your mortgage. What exactly is possible depends on the terms of your mortgage and the bank's policy rules. In some cases, changing the fixed interest rate period can lead to costs or penalties, while other lenders offer more flexibility.

If you want to change the fixed interest rate period of your mortgage, it is advisable to contact your lender or mortgage advisor to discuss the options. They can inform you about the conditions, costs, and possible consequences of changing the fixed interest rate period, so you can make a good decision based on your financial situation and objectives.