Table of contents

Are you planning to buy your first house soon? Then it’s important to know what costs are involved in the purchase. Besides the standard buyer's costs, there are also additional costs to consider. We warn you in advance: buying a house can hurt your wallet. But luckily, there are also deductible costs that can save you some money. In this article, we explain all these expenses and provide a calculation example, so you're well-prepared to enter the housing market.

The mandatory costs when buying a house (buyer's costs)

You may have noticed that behind the asking price of houses on Funda it says 'k.k.' or 'v.o.n.'. These abbreviations stand for 'kosten koper' (buyer's costs) and 'vrij op naam' (seller's costs). As you can guess, in the case of 'kosten koper', the buyer is responsible for the additional costs made during the purchase of the property. Think of transfer tax, notary fees, and valuation costs. If you buy a house 'vrij op naam', the seller is responsible for these costs.

Read all about buyer's costs and seller's costs.

The mandatory costs:

- Notary fees: The notary fees consist of different parts, such as the costs for the deed of transfer, mortgage deed, and other costs. Think of cadastral costs and VAT. The notary fees vary, but generally, you can expect an amount between €1,000 and €3,000. Request a quote from the notary in advance so you know exactly what amount you need to pay.

- Transfer tax: In 2023, you pay 2% transfer tax in the Netherlands on the purchase price of a house where you will live for a long time. If you meet certain conditions, you may be eligible for the starter exemption. In that case, you do not pay transfer tax. For other real estate, you pay 10.4% transfer tax in 2023.

Answer the questions and hear from multiple real estate agents how they can help you with the purchase of your new house. Tell real estate agents as much as possible about the type of property you are looking for.

Find a purchasing agent- Independent

- Without obligation

- Free

- Fast

Additional costs when buying a house

Already a bit shocked by the standard costs involved in buying your house? Hold on tight: you’ll also have to deal with additional costs. Whether this is the case, and what those costs are, depends on your situation. But before you throw in the towel, there is hope: in the next paragraph, we’ll discuss which costs are deductible for tax purposes. This will ultimately save you significantly in your wallet.

Mortgage and bank costs

In most cases, houses are bought through a mortgage loan, or: mortgage. Borrowing money costs money, which is why you pay a percentage of the borrowed amount (the mortgage interest) back to the mortgage lender. This percentage is included in the monthly amount you pay for your mortgage to the bank. Additionally, you pay the mortgage advisor brokerage fees. The costs of a mortgage advisor average €2,250. We have conveniently included the valuation costs and notary fees under the mandatory costs (see previous paragraph). Below, we address the insurance costs required for your mortgage.

Additionally, there are a number of costs associated with a mortgage:

- Valuation costs: The costs for a valuation report in the Netherlands vary depending on the type of house and the extent of the report. On average, the costs for a valuation report for a property range from €600 to €900, including VAT. Do you want to include a renovation or extension in the valuation? Then the price can be higher.

- Bank guarantee: In the case of buying a house, a bank guarantee is often requested as assurance that you, as the buyer, will fulfill your financial obligations, such as paying the purchase price. The cost of a bank guarantee varies per bank and depends on the amount for which the guarantee is issued and the duration of the guarantee. The bank generally charges 1% of the bank guarantee amount as costs.

- Reservation fee: If you, as the buyer, request a delay in the execution of the mortgage deed, the bank may charge an extra fee due to the delay. This is called the reservation fee. The amount of this fee varies per lender and can range from tens to hundreds of euros per day. Always check the terms of the lender in advance and check what costs are associated with a possible delay in the execution of the mortgage deed.

- Suretyship commission: Do you have a mortgage with National Mortgage Guarantee (NHG)? For taking out the NHG, you pay a suretyship commission, which is a one-time amount. In 2023, you pay 0.6% of the total mortgage amount for the suretyship commission. So suppose you take out a mortgage of €200,000 with NHG, you pay a one-time fee of €1,200. Within a few years, you will have recouped these costs, as you pay less mortgage interest with NHG.

- Building insurance and contents insurance: When you buy a house, it is wise to take out building insurance and contents insurance. Building insurance covers damage to the house itself, for example from fire, storm, or burglary. Taking out this insurance is often mandatory when taking out a mortgage. Contents insurance covers damage to the items in the house.

- Life insurance: It is wise to take out life insurance (ORV) when buying a house if you take out a mortgage and there is a (significant) financial risk for dependents if you or your partner dies. It may also be mandatory with some mortgage lenders. An ORV can help pay off the mortgage (partially) or cover monthly payments if you or your partner dies. It is advisable to seek advice from a financial advisor or mortgage advisor about the necessity and amount of an ORV in your specific situation when taking out a mortgage.

Other costs

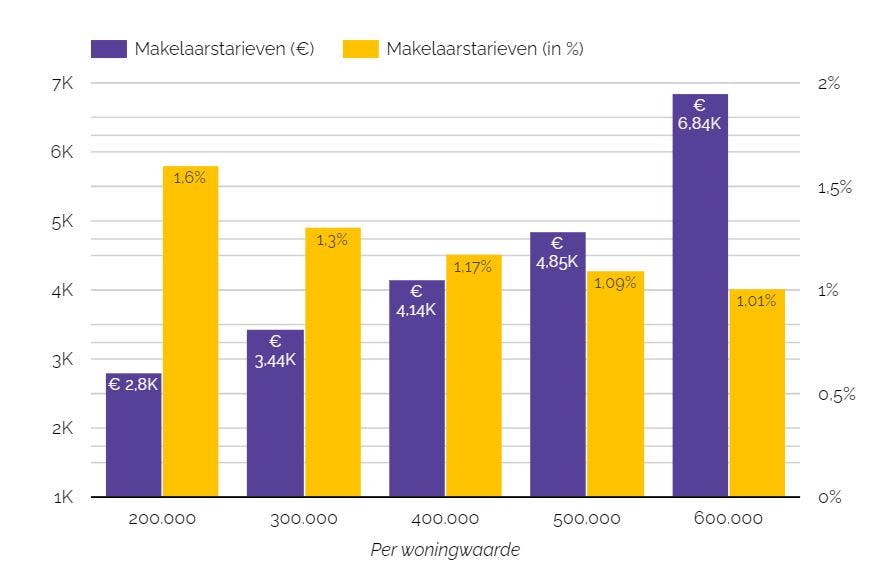

- Real estate agent fees: These are the fees (commission) charged by a real estate agent for assistance in purchasing a property. The costs for a purchasing agent are typically 1.1% of the purchase price of the property, but can also be a fixed fee (usually around €4,000 to €5,000). If you do not use full-service, but only a few partial services, you will, of course, pay less. Read more about the costs of a purchasing agent.

- Structural inspection: This is an inspection by an expert who assesses whether the house is in good condition and whether there are any hidden defects. The costs vary depending on the property, size, location, and complexity of the inspection. For a standard structural inspection, you can expect a price between €250 and €450

- Construction interest (new construction): This is the interest that the buyer of a newly built home pays to the builder/developer on the unpaid portion of the purchase price. It concerns the interest the builder has to pay on the borrowed money used for the construction of the property. As long as the property has not yet been delivered, the buyer is not able to pay the full purchase amount, and the construction interest is therefore calculated on the remaining amount. The costs of construction interest vary per construction project and can be included in the total financing costs of the property.

Read more about taking out a mortgage and the possibilities of buying a house without your own money.

Save on the fee of a purchasing agent?

Through Mijn Verkoopmakelaar, you can easily and quickly compare the prices of real estate agents with each other. Moreover, you can save up to 40% in real estate agent fees through our platform, as the agencies on our platform offer competitive rates.

Register via the form below and receive proposals from multiple real estate agents in the area!

Answer the questions and hear from multiple real estate agents how they can help you with the purchase of your new house. Tell real estate agents as much as possible about the type of property you are looking for.

Find a purchasing agent- Independent

- Without obligation

- Free

- Fast

Which costs are deductible for income tax?

So, you are now fully informed about the costs of buying a house. Now it's finally time for the fun part. A portion of those costs is deductible from taxes. This can lead to a (significant) tax advantage. Below we discuss the different costs that are tax-deductible, and the conditions attached to them.

- Mortgage interest: the mortgage interest you pay on your mortgage loan is under conditions deductible from taxes. Note: this only applies to loans taken out for financing the main residence, not for a loan for a second house or vacation home.

- Mortgage advisor: the costs incurred for advice on your mortgage, such as the advisory and brokerage fees of the mortgage advisor, are deductible.

- Notary fees: the costs incurred for the mortgage deed and the deed of transfer at the notary are deductible.

- Valuation costs: the costs for having a valuation carried out are deductible.

- Suretyship commission NHG: the suretyship commission for an NHG mortgage is tax-deductible. This only applies to the costs incurred for obtaining the NHG guarantee and not for any interest discounts that accompany it.

- Construction interest: If you buy a new-build home, you can under conditions deduct the paid construction interest as mortgage interest in Box 1 of the income tax. Note: there are specific rules and conditions. It is therefore wise to get well informed by a tax advisor or mortgage advisor. Read everything about the costs for a new-build house here.

Calculation example direct costs of purchasing a property

Buyer of the property is 30 years old and has a mortgage of €325,000

Asking price buyer's costs€350,000

Mandatory costs for buyer's costs: +€8,500

- Transfer tax 2023: €7,000 (2%)

- Notary fees: €1,500 average

Mortgage costs: +€3,000

- Mortgage advisor€2,250

- Valuation costs€750

Possible additional costs: +€2,300

- Bank guarantee (1% of deposit): €350

- Suretyship commission (0.6%): €1,950

Purchasing agent - real estate agent commission (1.3%): +€4,550

________

Total€366,050

Excl. possible additional costs (€2,300)

Read more about buying and selling your house

frequently asked questions

What are the mandatory costs when buying a house?

The mandatory costs consist of notary fees, transfer tax, and appraisal costs. Notary fees typically range between €1,000 and €3,000 and include, among other things, the deed of transfer, mortgage deed, land registry costs, and VAT. In 2023, you will pay 2% transfer tax on the purchase price of a house where you intend to live for an extended period. The costs of an appraisal report usually range from €600 to €900, including VAT.

What are additional costs when buying a house?

When buying a house, you will also encounter additional costs. Additional costs can include: fees for a mortgage advisor, bank guarantee, commitment fee, guarantee commission, structural inspection, building and contents insurance, life insurance, and real estate agent fees. The amount of these costs varies per situation and per service provider/lender.

Which costs are deductible when buying a house?

Some of the costs when purchasing a home are tax-deductible. Consider costs such as: mortgage interest for loans taken out to finance your home, advisory and mediation fees from the mortgage advisor, notary fees, appraisal costs, the guarantee commission for an NHG mortgage, and the construction interest paid for new-build homes under certain conditions. Note: make sure you are well informed about this by a tax advisor or mortgage advisor, as there are many specific rules and conditions that apply.

How much transfer tax do you pay if the house is resold within 6 months?

When a property is resold within a 6-month period, a special arrangement applies concerning the transfer tax. In this case, the amount of transfer tax paid during the first sale is deducted from the transfer tax due on the second sale. This arrangement applies to regular homes. Whether a property falls within the 6-month period is determined by the date of the deed of transfer.

This benefit usually accrues to the buyer (or acquirer) of the property, but it is possible to make different arrangements about this. For instance, the parties can agree that the seller of the property receives the mentioned 'benefit' instead of the buyer. This provides some flexibility in how this tax advantage is applied, depending on what both parties agree upon.