Table of contents

When a loved one passes away, there is a tremendous amount to deal with. In addition to grieving, you have to arrange all kinds of things that you would prefer not to deal with. Have you (together with others) inherited a property? Then a decision must be made about the destiny of the property, and maybe inheritance tax must be paid as well. In this article, we explain - without unnecessary jargon - what you need to consider when inheriting a property. Hopefully, it provides a little bit of relief in this difficult time.

Accept or refuse the inheritance?

We'll talk about your options when inheriting a property later on. But first, it's important to realize that you can choose whether to accept or refuse the inheritance. Initially, inheriting a house may not seem like something you would want to refuse. However, in some cases, it might be wise to think twice about accepting the inheritance. There could be a (high) mortgage debt on the house.

In addition, it's good to know that you can also - accidentally - accept the inheritance by performing certain actions, such as dividing the deceased's belongings. We'll explain it all to you.

Accepting the inheritance

If you choose to accept the inheritance, you can do this in two ways. In difficult terms, this is called 'pure acceptance' (unconditional) and 'beneficiary acceptance' (conditional). Don't worry: it sounds more complicated than it is.

Pure acceptance of the inheritance (unconditional)

A purely accepted inheritance also makes you as an heir liable for the debts from the inheritance. Think of a mortgage debt that is still on the house. Always check beforehand whether the sale proceeds of the property will be high enough to pay off the mortgage debt. If you're not sure about that, it's smarter to 'beneficiary' accept the inheritance. We explain what this means below.

Beneficial acceptance of the inheritance (conditional)

A beneficiary accepted inheritance means that you only accept the inheritance when the balance is positive (and the house is not under water). You then accept under the reservation of what is in the estate. This way, you can be sure that you don't have to pay any residual debt. Do you indeed want to accept beneficiary? You have to do this within three months after death. You arrange this by making a declaration at the court.

Important: do not perform actions that could lead to pure acceptance!

Watch out! If you want to accept beneficiary, you're not allowed to perform actions in the meantime that might (perhaps unintentionally) lead to pure acceptance. If you start dividing the estate or selling it, this is considered a pure acceptance. From that moment on, it is no longer possible to accept beneficiary.

Tip: If you want to accept beneficiary, first get advice on the rules from an expert. This way you can be sure that you won't be confronted with possible debts afterwards.

Refusing the inheritance

You can also refuse the inheritance. In that case, you 'reject' the inheritance and you are not responsible for the estate. This means that you are not involved in settling the inheritance. You receive nothing from the inheritance, but you are also not liable for any debts.

After death, disagreements can arise among the heirs. Read here how to deal with this disagreement.

Receive a proposal for the sale by email from multiple real estate agents in the area.

Receive a proposal for the sale by email from multiple real estate agents in the area.

- Independent

- No obligation

- Free

- Fast

What options are there when inheriting a bought house?

Have you chosen to accept the inheritance including the house? Then you now have to decide what you want to do with the house. You have different options, depending on whether you are the only heir or if there are multiple.

- Are you the only heir? In that case you have three options. You can live in the house yourself, you can rent the house, or you can sell it.

- Are there multiple heirs? Then you will have to discuss together what you want to do with the house. One of you can live in the house and buy out the rest of the heirs. But you can also choose to sell the house and distribute the money that comes from it.

What happens to an outstanding mortgage debt?

If you have purely accepted the inheritance, then you are also liable for the debts - such as a mortgage debt. If there is indeed still an outstanding mortgage debt on the house, first check if there is a life insurance policy attached to the mortgage. When this insurance pays out, you can pay off the mortgage in its entirety - or at least in part.

If you have accepted the inheritance on a beneficial basis, you are not liable for any possible mortgage debt.

Selling an inherited property

If you choose to sell the property, it is preferable to do this within 8 months of the death. After 8 months, you will have to pay inheritance tax on the property, as it then falls into your assets. And if the sales proceeds are not in your account, this can cause you problems. It may also have an impact on any allowances you receive.

During the period that the house is not yet sold, the regular costs - such as municipal taxes, energy costs, and insurance - must continue to be paid. So, keep that in mind.

Read all about selling your parents' house and choosing a real estate agent with heirs.

Want to sell the property quickly? We are here to help

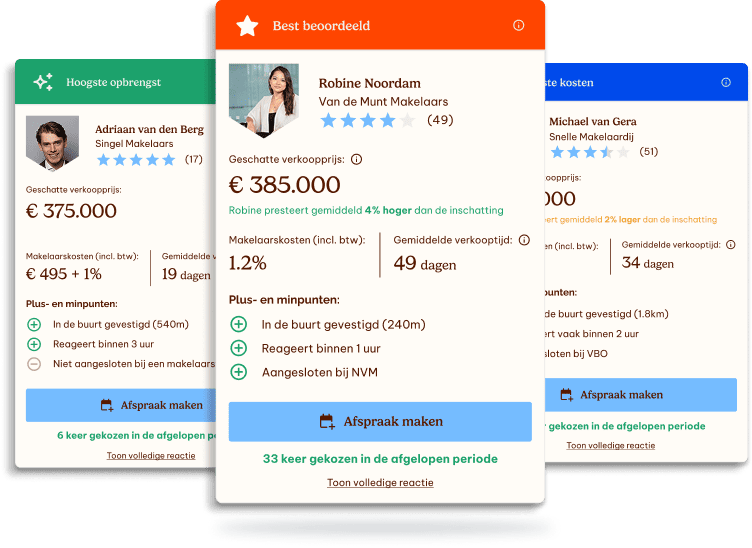

Do you want to sell the property as quickly as possible? Understandable. In our article about quickly selling your house, you can hopefully find useful tips. Tip: a good Real estate agent is actually half the work. They help you throughout the entire process and take a lot of work off your hands.

Have you not found a good Real estate agent yet or simply not had the time to look for one? We are happy to help. Enter your postcode and house number below, and register your property with Mijn Verkoopmakelaar. Completely free and without obligation. The best real estate agents in your area will send you a proposal. You decide whether and with whom you want to get in touch.

Read more here about how Mijn Verkoopmakelaar works or contact us.

Requesting a deferral for paying inheritance tax

Is the property still for sale 8 months after death? Then you can request a deferral of payment of inheritance tax. If the tax assessment is less than €50,000, one year's deferral is usually granted. If the assessment is more than €50,000 (and the house is for sale), the bank usually only grants a deferral if you provide additional security. Think of security in the form of a bank guarantee or a mortgage right.

Renting out an inherited property (temporarily)

Does it look like the property will not be sold within 8 months? Then you might consider renting the property until it's sold. Of course, you can also choose to rent out the property for a longer period. It is a way to bring in money in the meantime, with which you can pay the regular costs. Another advantage is that the property remains in use - this usually has a positive effect on the condition of the property and any garden. The condition deteriorates faster when it's empty.

Renting out property under the Vacancy Act

Good to know: the existence of the Vacancy Act. If you can't sell your house (yet) and therefore are at risk of financial problems, you can use this. You can rent out the property under the Vacancy Act for 5 years under a number of specific conditions. One of these conditions is that you can terminate the lease when the property is sold. The tenant will then have to leave the property and the new owner can move in right away. Read more about selling a rented house.

Living in an inherited property

You can (usually) also choose to live in the inherited property yourself. If there are multiple inheritors, the resident will have to 'buy out' the rest of the inheritors. They then receive their share of the property. How you approach this is explained below.

Determining the value of the property

Firstly, the value of the property must be established. You all decide together how you want to determine the value of the property. You could do this, for example, based on an appraisal report. Note: sometimes the will dictates how the value of the property should be determined. This value may differ from the WOZ value that you have to report in the inheritance tax declaration.

Buying out the other inheritors

Once the value of the property is established, the resident will have to buy out the other inheritors. The resident can do this from 'own resources', but for example, a mortgage can also be taken out. You usually cannot take over the mortgage of the inheritor (for example your parents), so you will have to take out a new mortgage yourself. Note: if the resident wants to rent out the property, different criteria apply to the mortgage. Think of a higher interest rate and a lower loan amount.

Usufructuary designated in will?

In most cases, you can decide who among the inheritors will live in the house. But sometimes it is different. The will may state that one specific inheritor may live in the property. This inheritor then gets the 'usufruct' over the property. This means that he or she is not the owner of the property, but is allowed to live in it. The usufructuary does not have to pay any compensation to the owner(s) for this.

The other inheritors, in that case, get the 'bare property' of the house. Even though they are the owners of the property, they cannot live in it themselves. They are also not allowed to sell, demolish, or give away the house.

Inheritance tax on the property

It is unfortunate, but also when inheriting a property, you often have to deal with the Tax Authorities. Almost always, that is unless you sell the property within 8 months, then you don't have to pay inheritance tax on it. In addition, certain exemptions apply, so you don't always have to pay inheritance tax. That's a plus!

8 months after a death, you must declare the inheritance tax. The house is counted for the inheritance tax if it has not yet been sold. If it turns out that you do indeed have to pay inheritance tax, the amount (usually) must have been paid about one year after the death.

What should inheritance tax be paid on?

You pay inheritance tax on the total acquisition, including the property. The amount of the inheritance tax for the property is determined based on the WOZ-value minus the mortgage debt.

How much inheritance tax needs to be paid?

Whether you pay any inheritance tax at all depends on the relationship you had with the deceased and the amount of the total acquisition. Exemptions apply up to a certain amount. The amount of the exemption also depends on the relationship you had with the deceased. In 2022, a spouse, registered partner or cohabiting partner has an exemption up to € 680.645. Children have an exemption up to € 21.559 in 2022.

Check here how much exemption you have for the inheritance tax.

If the value of the acquisition is higher than the exemption, then you pay inheritance tax on it. The percentage that you pay, therefore, depends on the relationship you had with the deceased. For example, you pay less inheritance tax as a partner or child than a inheriting cousin or niece. In addition, you pay a higher percentage on the part of the inheritance (above the exemption) that exceeds a certain amount. That amount is set at €130.424 in 2022.

Check in this table how much percent inheritance tax you pay.

Partners who inherit from the same inheritance are seen as one person

Good to know: partners who both receive an inheritance from the estate are seen as one person by the Tax Authorities. Keep this in mind when calculating the total inheritance tax.

- Independent

- No obligation

- Free

- Fast