Table of contents

New WOZ assessment: to object or not?

Every year, homeowners receive the newly determined WOZ-value in the period of January, February, and March. Below is explained in which cases it is wise to object and when it is not wise to object. It also explains how you can submit the objection.

Contents:

- WOZ-value of a house: what is it?

- Objecting to the WOZ-value

- Assessment of the WOZ-value

- Cases in which objecting is less advisable

1. WOZ-value of a house: what is it?

Each year, the municipality makes an estimate of the WOZ-value of your house. The WOZ assessment you receive at the beginning of 2023 is the estimate on the reference date of January 1, 2022. The assessment 'looks back' one year

WOZ stands for Wet Waardering Onroerende Zaken. The municipality estimates the value of your home. Based on this value, several taxes are calculated. Therefore, it is wise to be sharp about this.

The different taxes influenced by the WOZ-value:

This WOZ-value is used to determine the amount of the following taxes:

- Property Tax (OZB)

This is the municipal tax you pay for owning a house. You can find the rate on the OZB assessment. - Sewerage charges

This is determined by each municipality and is announced together with the OZB. - Income tax

This concerns the notional rental value. This is tax you pay because the Tax Office sees owning a home as income. This counts for Box 1. Changes in the WOZ-value are automatically passed on to the Tax Office by the municipality. An increase in the WOZ-value therefore means an increase in tax. - Water system levy

This tax is imposed by the water board and depends on the WOZ-value and the water board in which your house is located.

- Acquiring a home through a gift or inheritance

If you inherit a home or receive it as a gift, you must pay tax on this. To calculate the amount of this tax, the WOZ-value is used.

The factors determining the WOZ-value

The WOZ is annually determined and announced by the municipality in the months of January, February, or March of the new year.

The WOZ-value you now receive (beginning of 2023), is the estimated value as of the reference date of January 1, 2022 (so last year).

The municipality makes an estimate of what your house would sell for if it were sold on the reference date (January 1, 2022).

For this estimate, the municipality looks at the following factors:

- The type of house

- The size of the house

- The plot size (the size of the land on which the house stands)

- The location of the house

- How desirable the area is

- The year of construction of the house

2. Objecting to the WOZ-value

If you think the WOZ-value of your home is incorrect, you can object. You must submit this objection within 6 weeks, calculated from the date stated on the WOZ assessment.

These are the main options to object to the determined value:

- The WOZ-value has been set too high.

- The value is correctly set but does not comply with the principle of equality. For example, if other comparable houses in the neighborhood have received a lower WOZ-value.

- The WOZ-value has been set too low.

This is how you go about it:

- Wait for the assessment. It must arrive in the months of January, February, or March. Or check the WOZ-value register of the government to see if it is already known. You can look back at the WOZ-values up to 2016 at the value register.

- Request the appraisal report from your municipality directly via your municipality's website. In many cases, you will need Digid for this. This is the substantiation that the municipality has used to come to the value.

- Assess whether the valuation is too high. The municipality often substantiates the valuation with one or more comparable houses. It is up to you to check whether these houses are indeed comparable in terms of value or differ too much. For example, because they are completely renovated. Below you read more about how to do this.

- Submit an objection letter to the municipality within 6 weeks with your substantiation or an appraisal report. There are plenty of sample letters available online.

In some municipalities, you can get your right by calling. You might try this first, saving you time. You will have to search for the correct number on the municipality's website.

3. Assessment of the WOZ-value

When you check the WOZ-value of the assessment, you need to look at the comparable houses used by the municipality. You should compare these with your own home.

You are looking for elements on which your house 'scores worse' than the comparison houses. Think of:

- Environment

- Nuisance from, for example, wind turbines or traffic

- Unfavorable location

- Poor maintenance

- Soil contamination

- Adjusted house, which has a lower value compared to the neighbors

4. Cases in which objecting is less advisable

If you believe that the WOZ-value is overestimated, you can object. This can lead to the value being estimated lower. Because several taxes are estimated based on the WOZ-value, you will then pay less tax.

If you plan to sell your house soon, you should think twice. The WOZ-value of your home is visible to everyone.

Many buyers look at the WOZ-value of your home to determine what they will offer. A low WOZ-value can therefore negatively affect the sale.

Some real estate agents advise sellers that a high WOZ-value can help with the sale.

Testing sales plans

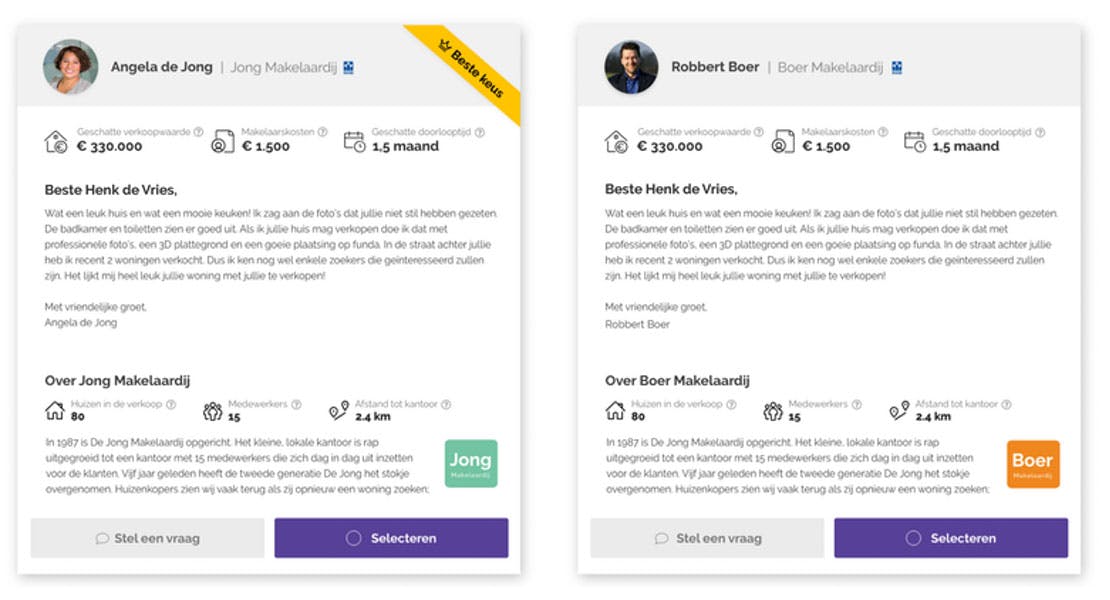

If you want to move this year, you can enter your postal code below. You can present your home to real estate agents from the area. They will respond with what they think of your home, what they charge for their services, and what they expect for sales proceeds.

Through Mijn Verkoopmakelaar, you don't need to have real estate agents come by one by one. By adding clear photos, the real estate agents can take a look remotely.

In this way, you can present your home to all the real estate agents from the area at once via Mijn Verkoopmakelaar. The real estate agents then respond with:

- Their approach

- Commission

- Expectation of the proceeds

Non-binding and free

Mijn Verkoopmakelaar is free. Real estate agents always respond non-bindingly, so you can still withdraw your application. Feel free to sign up if you're not sure when you want to move.

Frequently asked questions about WOZ

What is the WOZ?

The WOZ is an estimate of the value of your home by the municipality, upon which various taxes are calculated.

The WOZ is determined annually and announced in the months of January, February, or March of the new year. This varies by municipality.

The WOZ value you now (beginning of 2023) receive, is the estimated value as of January 1, 2022 (so last year).

What is the WOZ value important for?

The WOZ value is used to determine the amount of the following taxes:

- Property tax (OZB)

- Sewer charges

- Income tax

- Water system levy

- Acquisition of a house through a gift or inheritance.

A higher WOZ value almost always means higher taxes.

How is the WOZ value determined?

The municipality makes an estimate based on available market figures (such as from the land registry) of what the property would reasonably yield if it were sold on January 1, 2022.

For this, the municipality considers the following factors:

- The type of house

- The size of the house

- The plot size (the size of the land the house is on)

- The location of the house

- How desirable the area is

- The year the house was built

Where can I find my current WOZ value?

- You can directly look this up on the WOZ value portal of the government. You can view the WOZ value back to 2016.

- You can wait for the annual notice that is sent by the municipality between January 1 and March 30.

When is it wise to object to the WOZ value?

If you believe that the WOZ value has been incorrectly estimated, you can object.

Save on taxes Objecting can lead to a lower estimated value. Because several taxes are assessed based on the WOZ value, you pay less tax due to the reduction.

With sales plans If you plan to sell your house soon, you need to think carefully. Many buyers look at the WOZ value of your house to determine what they will offer. Therefore, a low WOZ value can have a negative effect on the sales opportunities.

How can I object?

You can object within 6 weeks after the date of the WOZ notice.

- Wait for the notice.

- Request immediately the valuation report from your municipality (via Digid) and assess if the comparable properties are indeed comparable.

- Do you indeed find the WOZ too high? Then submit an objection letter within 6 weeks to the municipality with your substantiation or an appraisal report. Sufficient example letters are available online for this.