Table of contents

This article is of use when you are planning to sell your mortgaged home in The Netherlands.

Selling your home with a mortgage is possible in the Netherlands

Believe it or not, it is really common to do so. Most people sell their home in the Netherlands before they completely paid off the mortgage.

A typical -mortgaged- sale in the Netherlands

A typical sale of a property looks like this in the Netherlands.

You and the buyer sign a purchase agreement. In this agreement it is stated what the price is, when the transport will be transferred and under what conditions the agreement is final.

Permission of the bank to sell your home with a mortgage

In your situation, there is still a mortgage in place at the moment of transfer. Therefore you need permission of the bank.

In normal situations, the bank will give you that permission. Bank might refrain from giving permission in the following situations:

- The sale price is lower than the outstanding loan

The transfer of a mortgaged property

The permission of the bank is usually conditional. The condition is that from the sale price, the notary firstly pays off the loan it provided.

On the day of transfer, the bank of the buyer provides the sale prices in escrow at the notary. Out of the sale price, the notary pays from the escrow account:

- The outstanding amount of the mortgage backed loan provided by your bank.

- The commission of your selling agent.

- His own notary fee.

- The remainder of the escrow account will be wired to your bank account.

After paying off the bank loan, the notary erase the collateralization of the property. This way, the buyer will be the owner of a 'clean' asset, free from third party rights.

- Multiple offers

- Verified agents

- Local experience

Selling your home when your mortgage is higher than the sale price

If you want to sell your mortgaged property, but the sale will not result in the complete pay-off of the loan, things will go a bit different.

The bank might not give you the permission for the sale. This depends on the actual circumstances. If the remaining loan is not too high, banks might give you the permission. In some cases, the bank asks that the remaining loan will be financed by someone else.

What happens to the earned equity?

What is equity?

Equity is the value in your home if you subtract the loan from the value.

For example:

The value of your home is: 300,000

The mortgage is: 250,000

In that case, your equity is 50,000

Taxation of equity

In the Netherlands, equity is not separately taxed, like in the US. Therefore, you don't have to pay capital gain tax.

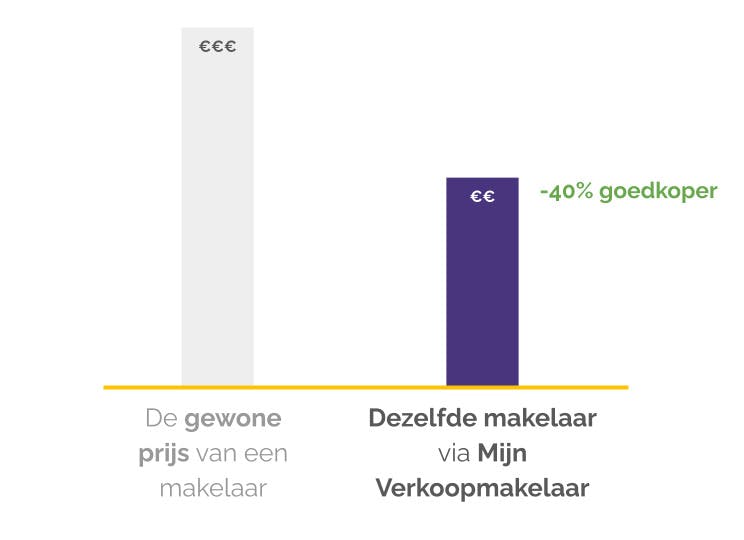

Mijn Verkoopmakelaar

Hopefully, this was of any help.

If you still have to select an estate agent, you can fill in your postal code and answer the follow-up questions.

The agents in the area will study your property and leave you a proposal. They know they are in competition with other agents, so they will make sure their fee is competitive.

We keep track of their performance, so that you are ensured of a good outcome.

Long story short:

- You get multiple offers of agents in your area

- We have curated the agents based on their previous results

- Using the service is free for you (agents share a small part of their fee)

- We keep your contact details shielded, so you don't get annoying calls

- Fill in your postal code below

If you experience any issues (language, for example) using the platform, feel free to contact us! We are here to help you in English with a Dutch accent ;).