Table of contents

The housing market during the Coronavirus

Since this week, stricter Corona measures have come into effect. Supermarkets are suddenly working overtime and freelancers are without work. The Coronavirus and the associated measures have a wide range of economic consequences for different markets.

We were curious about the effect of a virus outbreak on the housing market.

For this reason, we delved into the history of the effects of epidemics on the housing market in the hope of learning something about what awaits us now with the Corona virus and the real estate market.

Since we are not economists ourselves, we looked at what is known about this in science. Thanks to Chief Economist Svenja Gudell from Zillow's research division, we came to the following overview.

This is what we have learned:

- Historically, house prices hardly drop during epidemics, only the number of home sales decreases during the outbreak.

- Based on the available information from China, mainly news reports, house prices in China did not fall during the corona outbreak, and the number of sales in December and January decreased by 90%.

- Also during the SARS outbreak in 2003, there were no significant price drops seen in house prices in Hong Kong. However, the number of houses sold during that period decreased by 33-72%.

During an epidemic such as the Spanish flu in 1918 and 1919 or the SARS outbreak in 2003, economic activity can take a big hit (temporarily about 5-10% of GDP). Once the epidemic is over, economic activity quickly recovers to the old level.

This pattern is different from a normal recession not caused by an epidemic, such as the credit crisis. In that case, economic activity often declines for 6 to 18 months and then slowly recovers.

Short summary

What the housing market in the Netherlands will do now is unpredictable. Based on historical figures on virus outbreaks, house prices do not seem to fall due to a flu epidemic. However, the number of sales during an epidemic is significantly lower. After a virus outbreak, the housing market usually follows the trend it was following before the outbreak: same prices and the same number of home sales as before.

In China, the same seems to be happening at the moment, and the housing market is recovering. The number of sales temporarily declined, but house prices have remained at the same level.

Current housing market

To get a good picture of how the housing market in China has developed during the Corona outbreak, we rely on news reports, as official figures are not yet available.

Housing market in China during Corona

House prices in major Chinese cities rose slightly by 0.27% from December to January. To put that in perspective: before the outbreak, house prices were rising much faster. So a very slight influence on prices can be noted. The number of sales has decreased by 90%, according to a survey by China Merchants Securities, or according to other sources, Huatai Securities, even 98%.

Complete recovery expected

Figures for February are not yet available. According to Tanner Brown of MarketWatch, who wrote about the housing market in China during the Corona virus, real estate professionals in China expect they will soon be able to pick up the pace again, and the number of sales will return to the old level.

What is the best course of action if you want to sell?

The good news is that such virus outbreaks do not necessarily lead to depreciation of houses. The number of sales does decrease until the epidemic is over. Historically, the housing market simply follows the line it was already on.

For the proceeds of the sale, it does not matter whether you put a house up for sale now or after the outbreak. However, the sale during the Coronavirus will take longer. People are postponing 'unnecessary' contacts. Buyers will also not want to view for the time being.

If you want to wait and see the consequences first, you can use the coming months to prepare for the sale. So you are ready when the Corona epidemic is over, and the number of home sales increases again.

Use the time you have at home to paint the last walls and frames, choose a real estate agent who can sell later, and get advice on small adjustments you can make to your home to increase the sale proceeds.

In-depth: analysis of the housing market in Hong Kong during the SARS outbreak in 2003

The most recent epidemic similar to what we are experiencing now is the SARS outbreak in Hong Kong. Because this outbreak is relatively recent, there is a lot of data available on the economic consequences of the outbreak and the measures taken.

The SARS outbreak began in November 2002 in China's Guangdong province. In February 2003, the first infection in Hong Kong was confirmed. In March and April, the epidemic was at its peak. In May and June, it declined, after which Hong Kong was officially declared SARS-free by the WHO on June 23.

Economy of Hong Kong

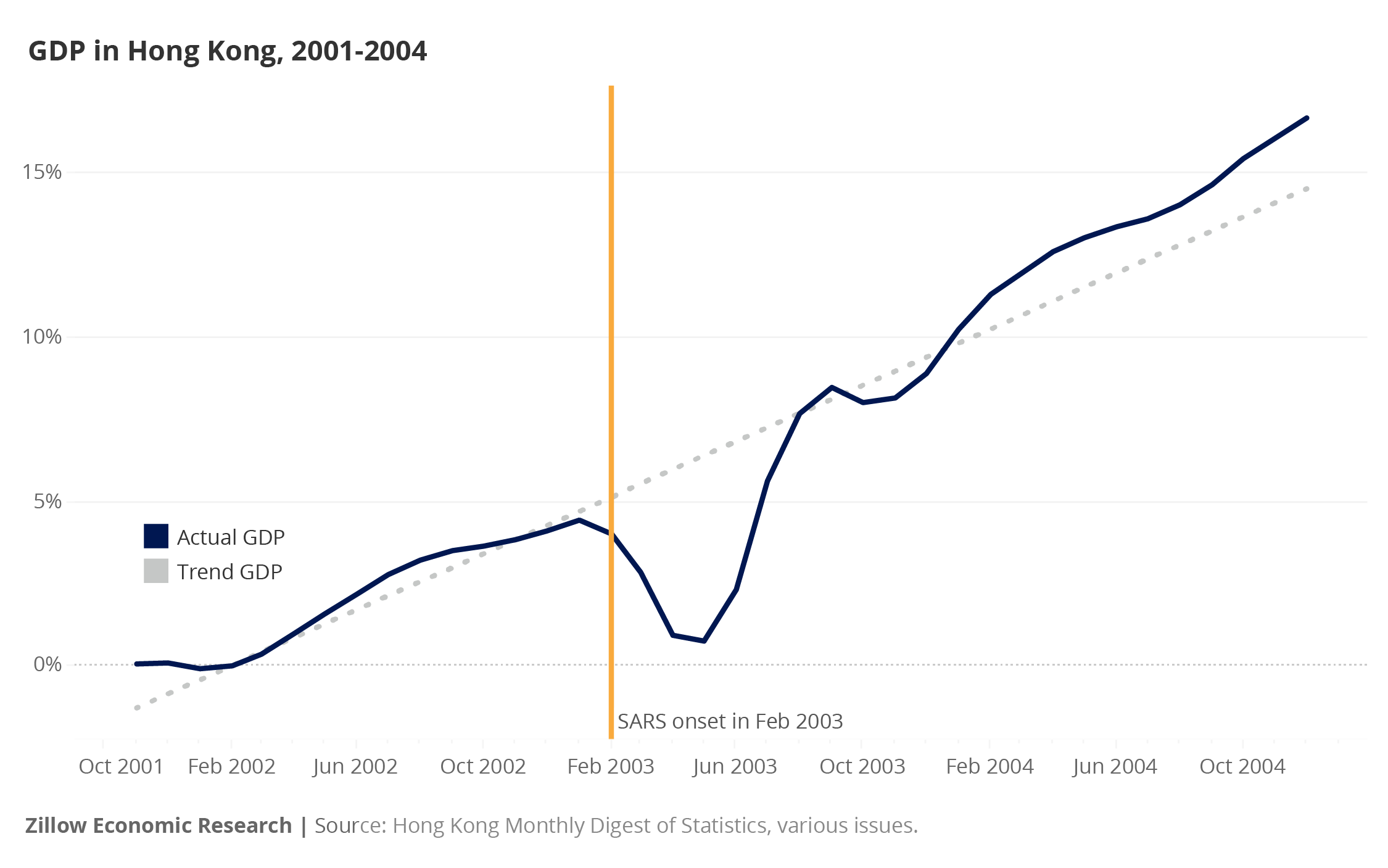

Before the SARS outbreak, the Hong Kong economy was growing, and unemployment was steadily declining. Hong Kong's GDP fell sharply during the outbreak. Estimates vary. Most authors assume a 5-6% decline in economic activity at the peak of the epidemic. During the same period, unemployment rose from 7.4% to 8.7%.

Source: Zillow Economic Research

Once the epidemic was over, economic growth followed the trend line it had set before the infection.

Housing market in Hong Kong

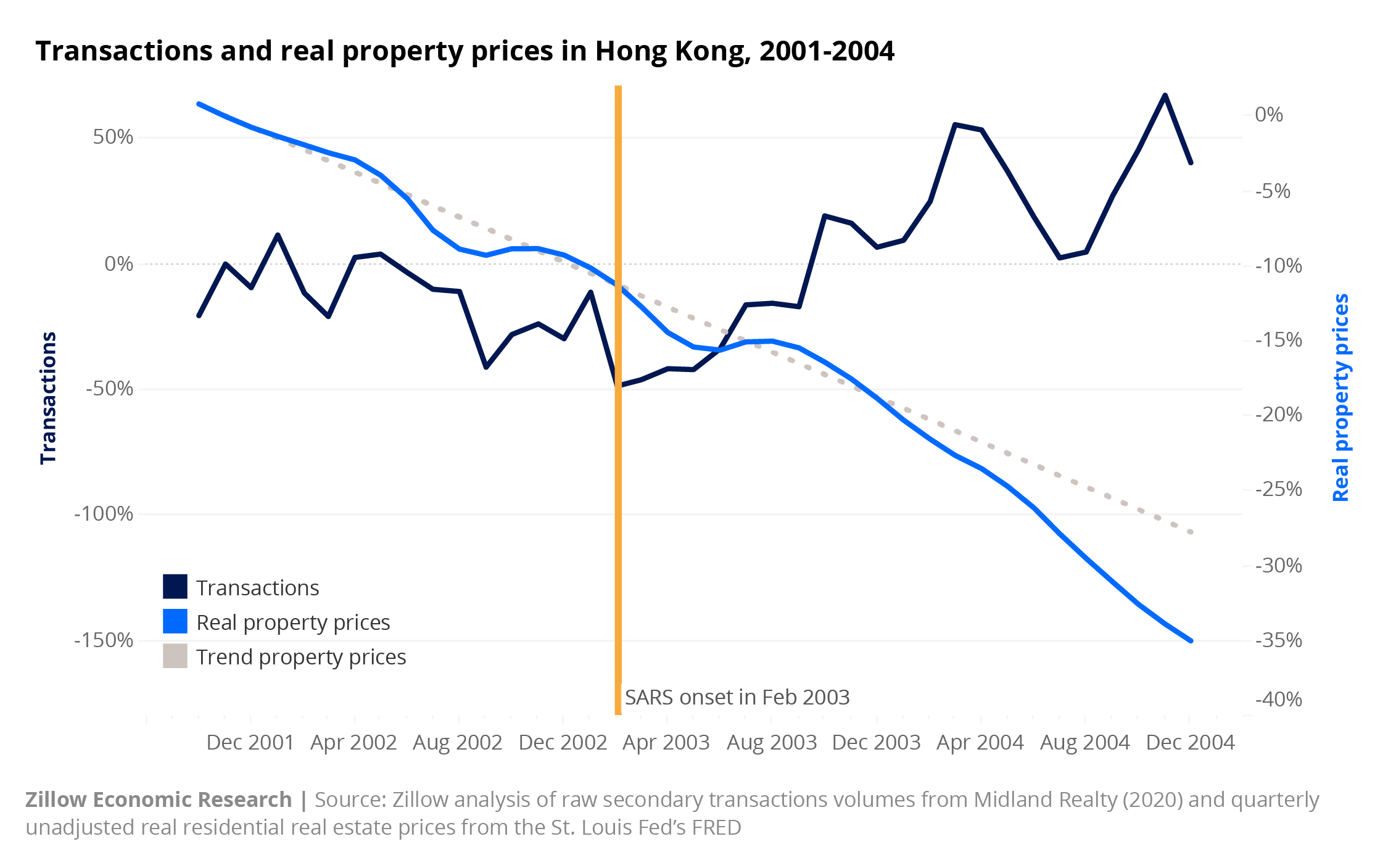

The housing market in Hong Kong had a downward trend before the outbreak. The number of houses being sold also slightly decreased.

Source: Zillow Economic Research

In February 2003, the SARS outbreak reached Hong Kong. The number of transactions in February, March, April, and May 2003 was 72% lower than in January 2003. Housing prices dropped by 1.6% during this period. Since fluctuations of 2 percent on a monthly basis occur more often, it is not entirely certain whether this was 'a normal fluctuation' or caused by the outbreak.

Avoiding unnecessary contact

Grace Wong, a researcher on the housing market during the SARS outbreak, explains the effect on the number of transactions by people's postponement behavior. According to her, people postpone unnecessary contact until after the epidemic.

In short

Also in 2003 in Hong Kong, the SARS virus had only a limited impact on the housing market. Housing prices did not decline significantly, only the number of homes sold declined sharply. Once the epidemic was over, the housing market fully recovered to the old situation.

Sources

Brown, Tanner, 2020. “Coronavirus slows China’s property market to a crawl — and even the most robust real-estate app is no match.” Marketwatch, February 2020.

Gudell, Svenja, 2020. “Information From Past Pandemics, And What We Can Learn: A Literature Review.” Zillow Research, March 2020.

Lieber, Ron, 2020. "Buying a Home During a Pandemic." The New York Times, March 2020.

Mohtashami, Logan, 2020. "Can the housing market withstand the coronavirus?" Housingwire.com, March 2020.

Taylor, Brown, 2020. "The Spanish Flu and the Stock Market: The Pandemic of 1919." Global Trade Mag, March 2020

Wong, Grace, 2008. “Has SARS Infected the Property Market? Evidence from Hong Kong.” Journal of Urban Economics 63(1), January 2008.

https://www.houstonproperties.com/coronavirus-houston-real-estate-impact

Vergelijk makelaars zonder dat ze langs hoeven te komen

Om een makelaar te kiezen, hoef je ze niet allemaal meer bij u thuis uit te nodigen. Door enkele foto's met je telefoon te maken, kun je je woning aan makelaars uit de buurt laten zien. In verband met het Corona-virus hebben we daar de mogelijkheid aan toegevoegd om met een filmpje uw woning te laten zien aan de makelaars. Hierdoor hoeven makelaars niet eerst bij u thuis langs te komen om de woning te zien, maar kunnen ze dat op afstand. Zij sturen u vervolgenss hun aanpak, tarief en hun verwachte verkoopopbrengst. U kunt de reacties vergelijken en uit al die makelaars kiezen welke uw woning mag verkopen.