Table of contents

Preventing double housing costs

Double housing costs are the expenses that result from owning 2 homes at the same time. This occurs when someone has bought a new (new construction) home and has not yet sold the old one. The owner then has to pay mortgage interest for both homes.

Below, it is explained when you risk double housing costs and what you can do to prevent them.

Risk of double housing costs

As an owner, you only risk double housing costs if you buy a home first, before your old home is sold.

In the current market, it is harder to find a home than to sell one. For this reason, most owners now choose to find their dream home first and then sell their old home. They therefore accept the risk of double housing costs.

Selling a home takes about 2 months

Homes sold in the months of April, May, and June 2019 were on the market for an average of 38 days. A terraced house is on the market for an average of 54 days.

| Type of home | Selling time |

| Average | 38 days |

| Terraced house | 54 days |

Selling speed varies by type of home

The exact sales opportunities of a home vary from case to case. If you have a starter apartment in the city center of a large city, the risk is not that great. These types of homes are usually sold quickly. It is different for a detached house in the east of the country. These homes are sold more slowly, for the simple reason that a smaller target group is interested in these types of homes.

| Large city | Small city | |

| Apartment | Fast | Average |

| Detached house | Average | Slow |

Preventing double housing costs

The simplest way to prevent double housing costs is to sell your current home first before buying a new one.

This answer is not practical in reality, because it is quite a challenge to find a new home in this market, and you do not want to be without a home.

We help you with the preparation, so you are not saddled with double housing costs.

Work from back to front

Do you have plans to move and do you own a home? Then work from back to front.

Know the selling speed, sales proceeds, and equity

Do not start by searching for your dream home, but begin by getting the best possible picture of the salability of your current house. This gives you an idea of how much you will get from selling your home and the expected speed at which your home can be sold.

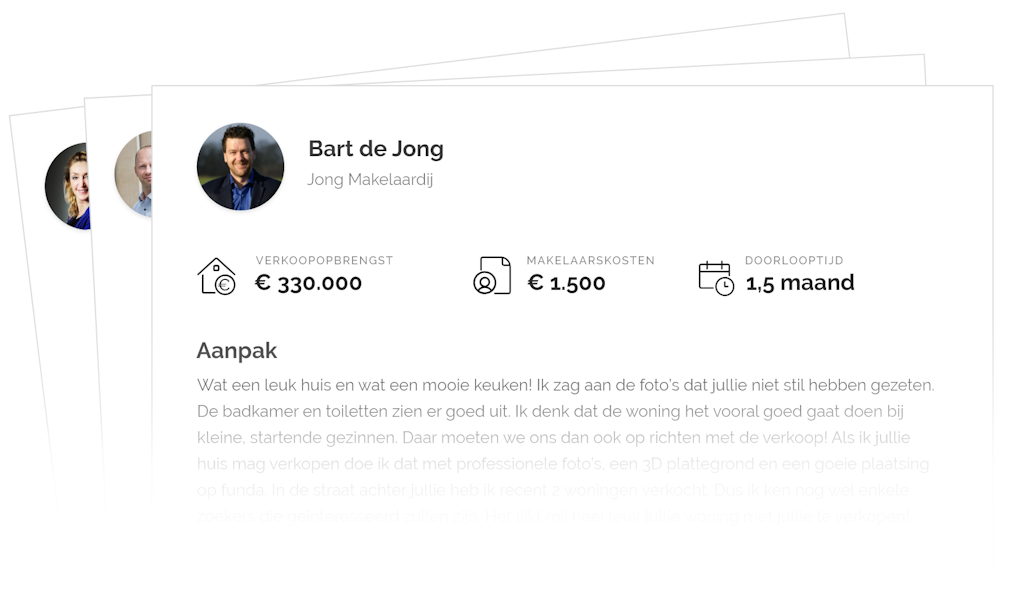

A local real estate agent is usually so well-informed about local market movements that they can tell you what a realistic return is and how quickly the home will be sold after a short glance.

Prepare a sale in advance

You can also make arrangements with the real estate agent for the moment when you have succeeded in buying a new home.

For example, you can agree with a real estate agent that the agent will do all the preparations, such as measuring the home and taking photos.

That way, your old home can be listed on Funda immediately after the successful purchase of the new home. This minimizes the risk of double housing costs.

Reverse approach also helps you with the purchase

Bid more

Because you know the expected proceeds, you can also calculate the expected equity. The equity, your savings, and your income together determine what kind of mortgage you can get.

A mortgage advisor can quickly tell you what you can borrow. Sometimes even for free or without obligation. At that moment, you will also immediately know your budget for your new house.

You win over other bidders if you know not approximately, but exactly what you can offer for a home. In this market, bidding 10,000 euros too little can make the difference between not getting and getting the house.

Advantage over other buyers

Sellers often also prefer owners who have already sorted out all finances in preparation. Then the chance for a seller is much greater that the sale will go through, because the likelihood that the bank will approve is high.

It's not surprising if you put yourself in the seller's shoes: would you prefer a seller who offers 5,000 euros more but is not sure if the bank will finance, or a seller who offers 5,000 euros less, but for whom financing will not be a problem?

Knowing in advance exactly what your current home will yield not only helps you prevent double housing costs but also increases your chances of finding your new home.

Summary

The best way to prevent double housing costs is to first get a good idea of the sales opportunities for your home. Then, with the knowledge of the equity, determine what you can offer. Next, ensure that together with the real estate agent your home is completely ready for sale. Finally, put the old home up for sale immediately after you have bought the new home.

Step-by-step plan

- Know the realistic sales proceeds and duration of your current home

- Based on your equity, savings, and income, know the maximum mortgage you can get for a new home

- Ensure the real estate agent has completed all preparations for the sale before you bid on a new home

- Find your new home

- Start selling your old home immediately after purchasing your new home

Ontdek jouw verkoopkansen

Om een goed beeld te krijgen van de verkoopkansen van je woning, kunt u uw woning door middel van foto's in één keer bij alle makelaars in de buurt aangeeft dat je mogelijk wilt verkopen.

Ontvang een verkoopvoorstel op maat van makelaars uit de buurt. Ontdek welke vraagprijs zij aanbevelen voor uw woning en welke kosten zij rekenen. Vergelijk alles in één handig overzicht, zodat u met gemak de beste keuze maakt.

Vul hieronder je postcode en huisnummer in en ontvang gratis verkoopadvies van makelaars uit de buurt.